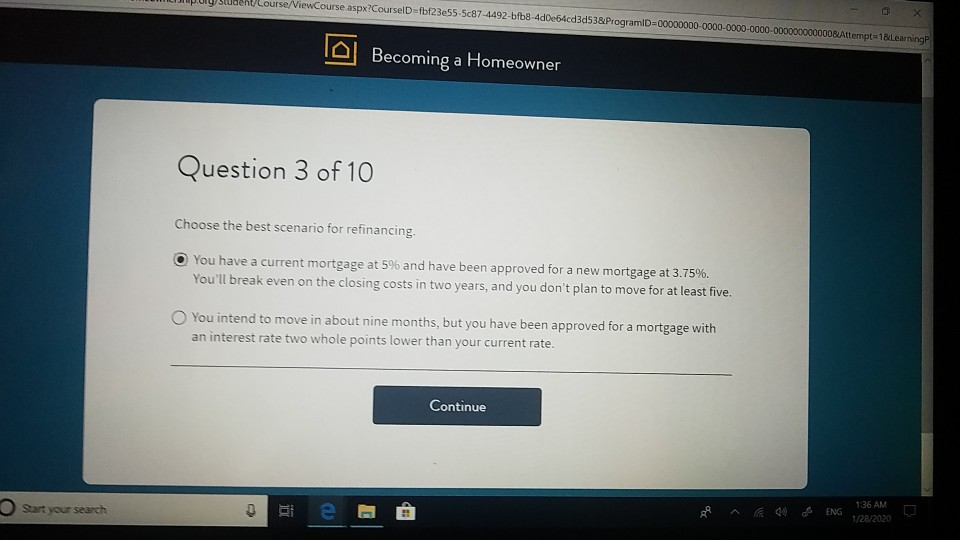

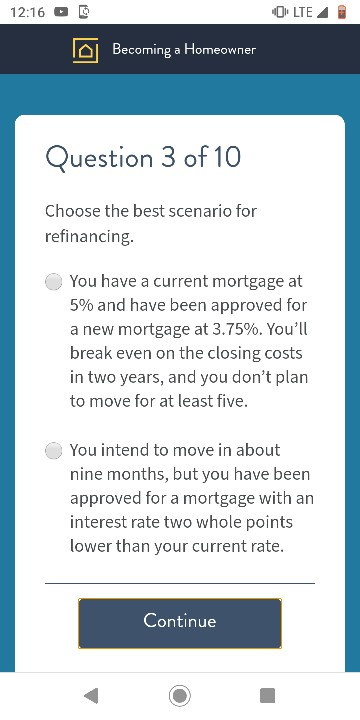

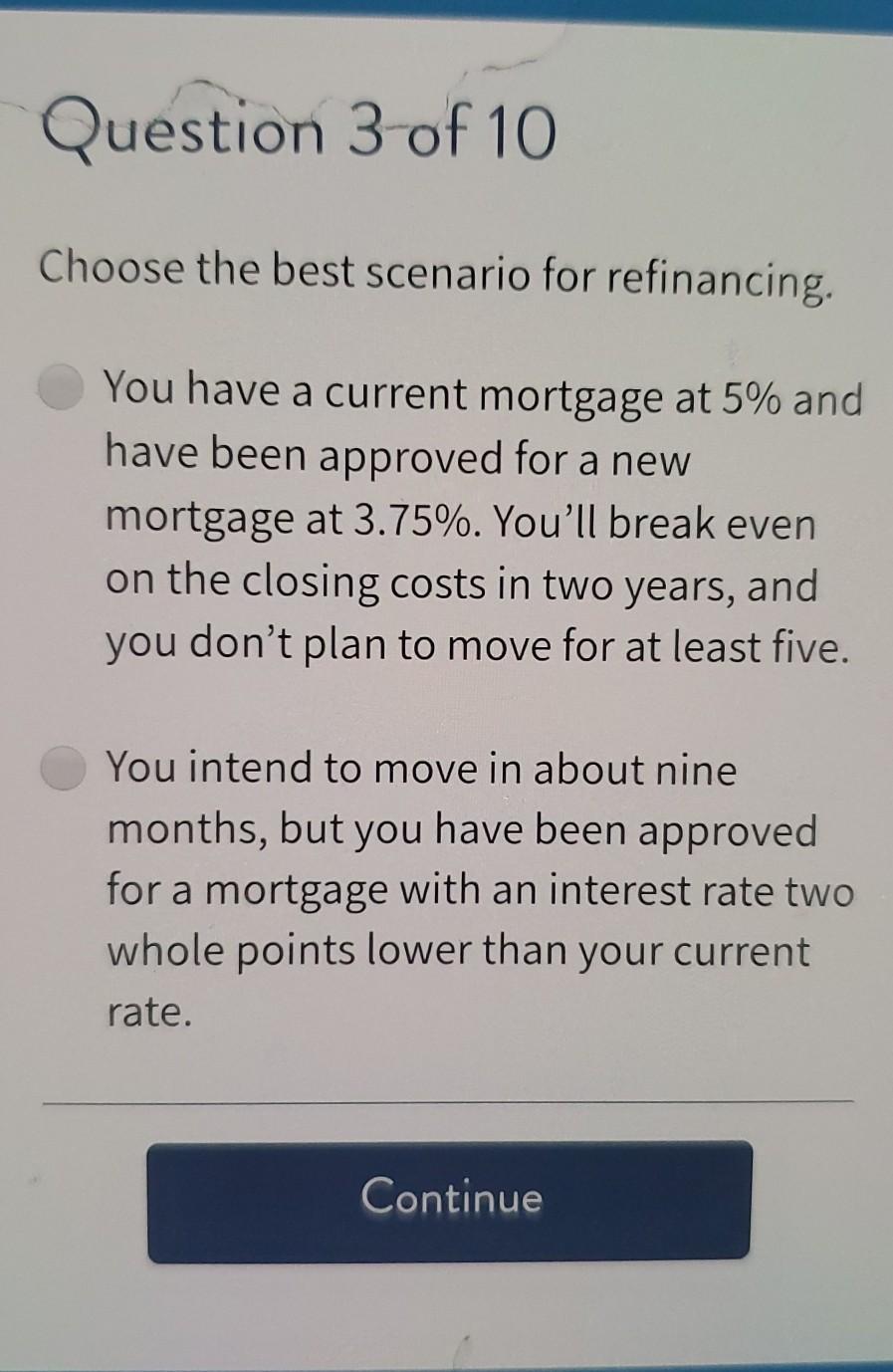

choose the best scenario for refinancing answer

When to consider a refinance of your reverse mortgage. That depends on a lot of factors including the purchase price of the home the type of loan you choose the property type the occupancy type your credit score and so on.

Pros And Cons Of Refinancing To A Shorter Mortgage Term

The CIBC Select Visa Card offers 0 interest on balance transfers for the first 10 months 1 transfer fee and after that you can count on its consistent 1399 interest rate on balance transfers as well as 1399 on cash advances and 1399 on purchases.

. One of the best features is the progress bar which is encouraging while paying off debt. Todays national 15-year refinance rate trends. Youll typically answer a few basic questions about your pet.

Citizens Bank offers low down payment options for several mortgage programs. Having money saved is what provides the means for you to take advantage of situationswhether its going back to college starting a new business or buying shares of stock when the market crashes. Remember that refinancing starts your loan over at day one.

The best time to speak with an HFA is at the beginning of your mortgage journey or anytime you would like assistance or advice determining the best path forward in property ownership. Contact a home loan originator to answer your mortgage questions and discuss your options. Having a will can help avoid that scenario and ensure that your assets are distributed according to your wishes.

Saving money or the saving habitas American author Napoleon Hill put it many years agois the foundation of all financial success. Selling equity in your home is a great use case for this versus alternatives like refinancing the debt or taking out a personal loan to pay of credit cards. This led to the country being ranked as the top place to live for expat families by the World Economic Forum back in 2018.

If youre 15 years into a 30-year mortgage starting over for a new 30-year term might not be particularly attractive. Hiring an attorney used to be the only way to have a will made. Now with online will makers you can create your will and other estate planning documents affordably 247 and access or download them instantly.

Heres a look at some common mortgage types to help you see which loan is right for you. Your home value has increased considerably. Your HFA can offer guidance on the best mortgage for you and help to determine what kind of property you can buy or which type of investment might work for you.

We have a number of business loan options like term loans invoice factoring merchant cash advance and more. If youre looking for one of the best mortgage brokers in Florida to take care of you look no further than Streamline Mortgage Solutions. Delancey Street provides small business loans nationwide.

We are now leaders in our field offering mortgage options to anyone purchasing a home in the state of Florida. Best Places To Live In The Netherlands The Netherlands attracts thousands of expats every year due to its stable economy exceptional education system and great quality healthcare facilities. If you choose you can also share your progress updates on Facebook and Twitter.

This app can be gifted neat gift idea. For today Monday May 23 2022 the national average 15-year fixed refinance APR is 4670 down compared to last weeks of 4780. Get a risk free consultation so you can learn your options today.

Lastly read through the Terms and Conditions and verify the accounts you would like to access in your Online Banking to complete the registration and start managing your accounts online. Choose the best pet insurance plan type for you. You can also use a pet insurance comparison site to look at several options at.

It also shows your debt payoff dates and interest saved. I can tell you that there are still zero down mortgage options available in certain situations including for USDA and VA loans and widely available 3 and 35 down. Currently the only card on the market to offer such a balance transfer promotional rate this.

What products are available to you will ultimately depend on your ability to qualify as well as which loan program best meets your needs. E started Streamline Mortgage Solutions in 2004 to offer customized services that allow clients access to the industrys best pricing. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan.

Set one security question and answer which will be used to verify that you are the only person who can change the password of your online banking account. With both refinancing and a personal loan you still have the debt on your credit report and youre still paying interest on the debt - likely high interest too even in the best cases.

What Is A Cash Out Refinance How Does It Work Ally

The Best Scenario For Refinancing At Best

Solved Vuiusuara Lourse Viewcourse Chegg Com

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

The Best Scenario For Refinancing At Best

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

Mortgage Forbearance Is It Right For You Quicken Loans

Solved Should I Refinance My Mortgage Bob Vila

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

The Best Scenario For Refinancing At Best

The Best Scenario For Refinancing At Best

How To Refinance Student Loans Money

Houston Mortgage Lenders New Home Loans Mortgage Refinance

Is Refinancing A Bad Idea Assurance Financial

Cash Out Refinance For Home Improvements Bankrate

Choose The Best Scenario For Refinancing

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)